Welcome to Markets Weekly! September, the seasonally weakest period of the year, is off to a lukewarm start, propped up by sharp moves in Google and Broadcom. Here’s what moved markets last week:

📉 US labor market weakened further

🪙 Gold continued its surge

🔎 Google hit all-time highs on verdict

📶 Broadcom reported strong earnings

🧘🏻♀️ Lululemon stock does downward-dog pose

📜 Bonds yields dropped to end the week

Read on below.

Contents

📈 Last Week’s Recap

The three major indexes ended the week mostly flat, dragged down on Friday as investors digested an underwhelming jobs report.

Index | Price | Performance | Performance |

|---|---|---|---|

S&P500 | 6,481.50 | 0.33% | 10.20% |

Dow 30 | 45,400.86 | -0.32% | 6.71% |

Nasdaq 100 | 23,652.44 | 1.01% | 12.57% |

BTC / USD | 110,862.70 | 1.44% | 18.68% |

Gold (GLD) | 331.05 | 4.08% | 36.72% |

USD (DXY) | 97.77 | -0.02% | -9.91% |

Key Takeaways

US unemployment rises to 4.3%, highest since 2021 : Only 22K jobs were added in Aug, cementing a Fed rate cut in Sep

Gold prices surged past $115/gm : Driven by fears of a deteriorating economy, tariff-driven inflation, and record-high central bank buying

Tariff battle ongoing : A court ruled President Trump’s use of emergency powers for tariffs is illegal, weakening U.S. negotiating leverage and prompting an appeal to the Supreme Court

Google soared 11% after favorable antitrust case verdict : It avoided the divestiture of Chrome and cease of payments to Apple to be the default search engine

Broadcom delivered strong earnings and announced new $10B AI chip customer : The customer is rumored to be Open AI

Lululemon plunged 18%, now down -56% ytd : The company cut its full-year guidance a second time, citing a steep decline in its key U.S. market and tariff impacts

Economic Data Recap

Report | Period | Median Forecast | Actual |

|---|---|---|---|

ISM Mfg | Aug | 48.5% | 48.7% |

US Trade Deficit | Jul | -$77.8B | -$78.3B |

ISM Services | Aug | 50.8% | 52.0% |

US Jobs Report | Aug | +75,000 | +22,000 |

US Unempl Rate | Aug | 4.3% | 4.3% |

Notable Earnings Recap

Company | Qtr Revenue | Qtr EPS | YTD Performance |

|---|---|---|---|

Zscaler (ZS) | $719.2M | $0.89 | 52% |

Salesforce (CRM) | $10.24B | $2.91 | -25% |

HP Ent (HPE) | $9.13B | $0.44 | 10% |

Broadcom (AVGO) | $15.95B | $1.68 | 44% |

Lululemon (LULU) | $2.53B | $3.10 | -56% |

💡Weekly Spotlight

What Are Defensive Sectors?

Defensive sectors are industries that tend to remain stable or perform well even during economic downturns. They provide essential goods and services that people need regardless of the economy’s health, making them less sensitive to market volatility. Investors often add a mix of defensive stocks to their portfolios to safeguard against uncertainty.

Key Characteristics

Stable Demand : Products or services that are necessities

Low Volatility : Stocks that have lower price swings, often measured by beta

Beta : Measure of a stock’s volatility vs the S&P500. A beta below 1.0 indicates less volatility than the market, while a beta above 1.0 suggests greater volatilityReliable Dividends

Examples Of Defensive Sectors

Consumer Staples : Everyday essentials household goods

Eg. P&G (PG), Coca Cola (KO)Utilities : Essential services like electricity, water & gas

Eg. Duke Energy (DUK), NextEra Energy (NEE)Healthcare : Pharma, medical devices & healthcare services

Eg. J&J (JNJ), United Health Group (UNH)

🗓️ The Week Ahead

Coming off a lackluster jobs report, it will be interesting to see how the market digests the data. With the major indexes just shy of all-time highs and a rally that has gone straight up since April, a healthy pullback would not be implausible and could present opportunities to add to favorite names.

Key Market Moving Events To Watch

Oracle earnings on Tues, 9-Sep (AMC)

Iphone 17 launch on Tues, 9-Sep

US PPI Data (producer inflation report) on Wed, 10-Sep

US CPI Data (consumer inflation report) on Thurs, 11-Sep

ECB Interest Rate Decision on Thurs, 11-Sep

UK GDP on Fri, 12-Sep

Upcoming Economic Data Releases

Report | Period | Date | Median Forecast |

|---|---|---|---|

Consumer Credit | July | 08-Sep | $15B |

PPI + Core PPI | Aug | 10-Sep | 3.3% |

CPI + Core CPI | Aug | 11-Sep | 2.7% |

Upcoming Notable Earnings

Company | Date | Qtr EPS | YTD Performance |

|---|---|---|---|

Oracle (ORCL) | 08-Sep | $1.15 | 40% |

Sailpoint (SAIL) | 09-Sep | $0.04 | 0% |

Synopsys (SNPS) | 09-Sep | $2.76 | 23% |

Rubrik (RBRK) | 09-Sep | -$0.71 | 39% |

Kroger (KR) | 11-Sep | $1.00 | 11% |

Adobe (ADBE) | 11-Sep | $4.21 | -22% |

🎯 This Week’s Pick

XLV (SPDR Health Care Sector)

XLV $137.90 (0.34%)

Profile

XLV is the largest ETF providing broad exposure to the S&P 500's healthcare sector. It includes companies from pharmaceuticals, biotech, healthcare equipment, and managed care. It’s biggest holdings are Eli Lilly, Johnson & Johnson, & United Health.

Fundamental Overview

Healthcare has significantly underperformed the S&P 500 this year, dragged down by drops in key holdings like Eli Lilly and UnitedHealth. The sector's forward P/E of ~17.4x is well below its historical avg of 19-22x, indicating it is currently undervalued.

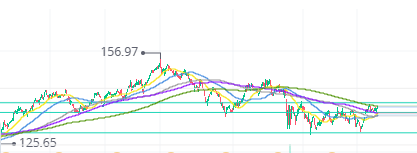

Technical Overview

XLV has been consolidating above it’s $136 support level, and is now sitting above its 20, 50 & 120 day SMAs. It looks set breakout above its 200 day SMA and begin a medium-term uptrend.

🚀 Bonus Pick - Future Play

Samsara Inc.

IOT $42.09 (17.44%)

Profile

Samsara Inc. is a leading IoT company that provides a Connected Operations Cloud platform. Its technology links physical assets, such as vehicles, equipment, and entire facilities, to the internet. This allows companies in industries like transportation and logistics to collect and analyze real-time data from their physical world.

Competitive Advantage (Or Moat)

Its all-in-one platform integrates hardware, AI, and analytics, creating high switching costs, and its large partner ecosystem.

Fundamental Overview

The company recently reported a strong beat on earnings and revenue, with 30% YoY growth. It added a record number of large enterprise customers and raised its full-year guidance.

Risks & Considerations

This is a high-growth, high-risk stock facing a competitive market. Its valuation is sensitive to its ability to maintain its high growth rate.

✒️ About The Author

Ali Husain

Ali is a full-time equity trader and investor based in Dubai, and the founder of First Mile Investing. He left his corporate career in 2024 to pursue his passion for the markets. He founded First Mile Investing to help beginners take their first confident steps into investing, with the goal of making the process less intimidating, more accessible, and empowering for everyone.

Know someone who might find this newsletter useful?

Ready to take the next step in your investing journey?

At First Mile Investing, we walk you through the basics of account setup and portfolio building so you feel confident making your own informed investing decisions.

Or reach out to us at [email protected]

Disclaimer:

The weekly newsletters are not trade alerts or recommendations to buy or sell any securities. First Mile Investing is not a licensed financial advisor. The information shared is for educational and informational purposes only and should not be considered financial advice. Investing involves risk, including the possible loss of capital. While risks can sometimes be managed, all investment decisions are your sole responsibility. Always conduct your own research before making any financial decisions. We are simply sharing opinions and educational material with no guarantee of profits or protection from losses.