Welcome to Markets Weekly! Despite major indices closing the week flat, the week buzzed with more AI deals, commodity shifts, and critical economic data. Here’s everything you need to know and more.

🦾 Alibaba’s AI power-up

🔋 US eyes lithium stake

🤖 NVIDIA backs OpenAI

☕ Coffee supply tightens further

🪙 Precious metals surge

📉 Crypto dips

Read on below.

📢 Reader’s Voice

"The format makes it super easy to get quick takeaways on the market and economy. I especially enjoy the “Future Pick” section, as I’m always seeking out interesting growth stocks to add to my portfolio."

- James Wallace, Electronic Arts (EA), Canada

Have insights or feedback? Reply with your thoughts for a chance to be featured to 1K+ readers

📈 Last Week’s Recap

Markets paused after weeks of gains, with indices ending slightly lower, but still up in September. Commodities outperformed, led by precious metals. Economic data was broadly encouraging, though persistent inflation and weak consumer sentiment highlight ongoing challenges.

| Index | Price (USD) | MTD | YTD |

|---|---|---|---|

| S&P 500 | 6,643.7 | +2.84% | +12.96% |

| Dow 30 | 46,247.3 | +1.54% | +8.70% |

| Nasdaq 100 | 24,503.9 | +4.65% | +16.62% |

| BTC / USD | 109,600 | +1.24% | +17.35% |

| Gold (GLD) | 346.7 | +9.01% | +41.28% |

| USD (DXY) | 98.18 | +0.17% | -9.50% |

Key Takeaways

Alibaba jumps on AI spending boost : Its NYSE listed ADR rose 6% this week, up 104% YTD, after unveiling its Qwen3-Max model and $53B AI infrastructure spending plans.

US eyes stake in Lithium Americas : Government negotiating a 10% stake in the Canadian miner. Its stock, LAC, nearly doubled on the news.

Coffee prices climb on tight supply : US tariffs on Brazil, weak harvests, and La Niña fears have pushed prices up 18% YTD.

Precious metals hit record highs : Gold +40% YTD, but Silver (+60%) and Platinum (+78%) have surged even higher.

Brent crude at $70/barrel : Benchmark oil prices hit a two-month high as geopolitical tensions and supply risk concerns rise.

Nvidia backs OpenAI with $100B deal : Chipmaker investing to expand AI ecosystem, though deal highlights risks of closed-loop AI spending between key players like Nvidia, Oracle, OpenAI.

PCE inflation ticks up to 2.7% : Core PCE at 2.9%, both in line with forecasts. Highest since February, and still above Fed’s 2% target. Markets still expect two more rate-cuts this year.

Personal Consumption Expenditures (PCE) : Tracks price changes in consumer spending on goods & services.Core PCE : PCE excluding food & energy.

EA nears $50B deal to go private : Silver Lake and Saudi PIF reportedly lead deal to take videogame maker Electronic Arts private in a record leveraged buyout. EA closed the week up 12%.

TikTok US deal progresses : ByteDance to license algorithm and retain profit share, potentially capturing over half of US profits.

Crypto and related stocks dip : BTC -5.5% and ETH -10% on the week to test key support levels. However, Oct-Dec is the seasonally strongest period for this asset class.

Economic Data Recap

Notable Earnings Recap

| Name (Ticker) | Qtr Rev |

Qtr EPS |

YTD |

|---|---|---|---|

| Micron (MU) |

$11.32 B

|

$3.03

|

87% |

| Accenture (ACN) |

$17.60 B

|

$3.03

|

-32% |

| Jabil (JBL) |

$8.25 B

|

$3.29

|

+50% |

| Costco (COST) |

$86.16 B

|

$5.87

|

0% |

🔦 Weekly Spotlight

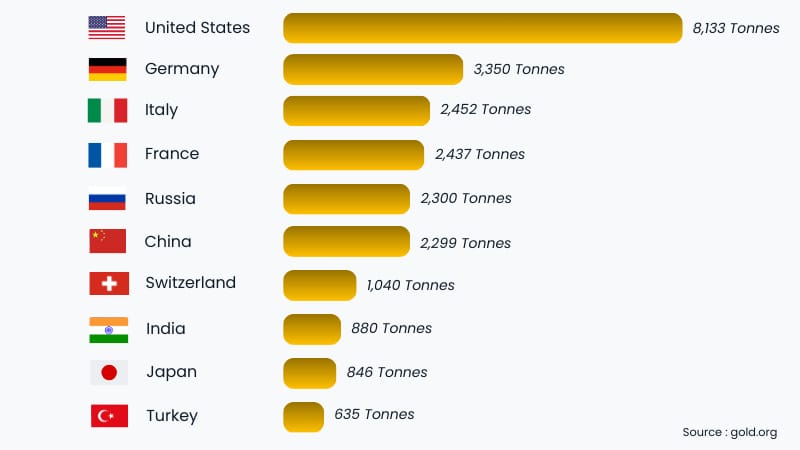

🪙 Global Gold Rush - Who Owns The Most

Gold has surged over 40% YTD, putting it on pace for its best annual performance since 1979. This rally has been fueled by geopolitical and trade tensions, sticky inflation, a weakening US dollar, and critically, record-breaking demand from central banks.

Why Central Banks Buy Gold

Gold reserves held by central banks serve as a hedge against economic uncertainty, inflation, currency fluctuations and as a sanctions-proof store of value.

Here are the top 10 holders as of Q2 2025:

The Top Buyers In 2025

Estimates say that net purchases by central banks have surpassed 800 tonnes YTD, surpassing 2024’s record. Poland (~67t), China (~44t), India (~23t), Turkey (~15t) and Kazakhstan (~15t) have reportedly been the biggest buyers.

Conclusion

This institutional purchasing is a fundamental, structural change in how nations secure wealth, not a short-term trade. With demand projected to be over 1,000 tonnes in 2026, these central banks create a robust price floor for gold, as they are strategically unlikely to sell their holdings.

🗓️ The Week Ahead

The spotlight this week will be Friday’s US jobs report. A strong report could push the Fed to reconsider pausing cuts, while a weak one will reinforce the case to continue easing. Alongside jobs data, ongoing geopolitical issues, potentially more AI deals, and updates on manufacturing and consumer health will drive markets.

Nike (NKE) earnings : Mon, 30-Sep. Analysts watching China demand, margins, and inventory trends.

US Government shutdown : Odds at 63%, risking suspension of key US economic data if no funding deal is passed by 01-Oct. Markets are on close watch.

Consumer Confidence : Tues, 30-Sep

Measures consumer confidence in the US economy via surveys. Above 80 = optimism, below 70 = rising pessimism.ADP Employment Report : Wed, 01-Oct

Tracks monthly private-sector job creation. Often viewed as a preview of nonfarm payrolls.ISM Manufacturing PMI : Wed, 01-Oct

Survey of purchasing managers. Above 50 indicates expansion, below 50 signals contraction.Russia-Ukraine & Oil : Ongoing US pressure on allies to curb Russian oil could sway prices.

TikTok Deal : Negotiations expected to wrap up. Outcome will influence US-China relations.

US Nonfarm Payrolls, Unemployment Rate & Hourly Wages : Fri, 03-Oct

Nonfarm Payrolls track monthly US job creation, Unemployment Rate gauges labor market health, and Hourly Wages measure inflationary wage pressures.ISM Services PMI : Fri, 03-Oct

Survey of service sector activity. Above 50 = expansion, below 50 = contraction.

Upcoming Economic Data Releases

| Report | Period | Date | Med Fcst |

|---|---|---|---|

| Consumer Confidence | Sep | 30-Sep | 95.8 |

| ADP Employment | Sep | 01-Oct | 40,000 |

| US Nonfarm Payrolls | Sep | 03-Oct | 45,000 |

| US Unemployment Rate | Sep | 03-Oct | 4.3% |

Upcoming Notable Earnings

🎯 This Week’s Pick

Elevance Health

| Market Cap | P/E | Fwd P/E | YTD |

|---|---|---|---|

| $71.74B | 13.56 | 10.12 | -13.63% |

Profile

Elevance Health (formerly Anthem) is one of the largest US health insurers, providing medical, pharmacy, dental, and behavioral health coverage to over 140 million members. It operates through brands like Blue Cross Blue Shield across multiple states and serves both commercial and government programs. Its scale, diversification and broad footprint make it a behemoth in the managed care sector.

Fundamental Overview

ELV and its industry peers have been beaten down over the last two years due to regulatory scrutiny, reimbursement cuts, and persistently high Medical Cost Ratios (MCRs). Sentiment worsened earlier this year when industry leader UnitedHealth stumbled, dragging Elevance and the broader managed care group down even further.

Despite this, Elevance continues to grow revenues and cash flow consistently, supported by its large and diversified membership base. It now trades at a forward P/E of ~10.1, a deep discount to historical averages. Its headwinds are expected to ease in 2026, when insurers reprice contracts and adjust premiums, making it an attractive contrarian play.

Technical Overview

ELV’s chart over the last year looks somewhat like a murder scene. However, in recent weeks thanks to improving sentiment, and its big brother, UnitedHealth getting a boost from a huge Warren Buffett stake, it has climbed back above its 20 and 50-day moving averages. $300 is now a key support level, and if it holds through earnings on 16-Oct, ELV could have room to run toward its next key levels of $355 and $420.

🚀 Future Play

Rubrik

| Market Cap | P/E | Fwd P/E | YTD |

|---|---|---|---|

| $16.22B | — | — | +25.69% |

Profile

Rubrik is a cloud data management and cybersecurity company specializing in backup, disaster recovery, and ransomware protection. Its platform is built on data immutability, meaning once data is stored it cannot be altered or deleted by attackers. For example, if a hospital’s patient records are attacked by ransomware, Rubrik restores the system to a clean, uncompromised state within hours instead of weeks. The company supports hybrid and multi-cloud environments, making it a critical safeguard for industries like healthcare, finance, and government.

Competitive Advantage

Rubrik stands out because it combines data backup with cybersecurity tools that detect and stop threats. Its system uses AI to spot unusual activity and protect against ransomware. Unlike older companies such as Commvault or Veritas, Rubrik is focused on modern cloud environments. It has a strong partner ecosystem, integrating with top cybersecurity companies like CrowdStrike and Zscaler, as well as cloud providers like AWS and Google Cloud.

Fundamental Overview

Rubrik is growing fast, with subscription ARR (a forward-looking metric of annualized subscription sales) reaching $1.25 billion in Q2 FY26, up 36% YoY. Actual quarterly revenue rose 51% YoY to $310 million. While still not profitable, Rubrik generated $58 million in free cash flow, a key milestone. However, its lofty price-to-sales ratio of ~14.5 reflects a premium valuation.

Risks & Considerations

Rubrik faces competition from both legacy players and peers like Cohesity. Its stock has surged over 150% in the past year, fueled by the cloud and AI growth narrative, and insiders have taken advantage with roughly $350 million in stock sales. Therefore, investors should remain mindful of its premium valuation. Continued upside will depend on maintaining its lofty growth expectations, product innovation and a setting a clear path to profitability.

👋🏼 About The Author

Ali Husain

Ali is a full-time equity trader and investor based in Dubai, and the founder of First Mile Investing. He left his corporate career in 2024 to pursue his passion for the markets. He founded First Mile Investing to help beginners take their first confident steps into investing, with the goal of making the process less intimidating, more accessible, and empowering for everyone.

Know someone who might find this newsletter useful?

Or reach out to us at [email protected] if you have some feedback.

Ready to take the next step in your investing journey?

At First Mile Investing, we walk you through the basics of account setup and portfolio building so you feel confident making your own informed investing decisions.

Copyright Notice

All content, analysis, and visuals in Markets Weekly are the intellectual property of the author. Unauthorized copying, distribution, or reproduction of this newsletter, including its images, ideas, and research, is strictly prohibited without prior written consent.

Disclaimer

The weekly newsletters are not trade alerts or recommendations to buy or sell any securities. First Mile Investing is not a licensed financial advisor. The information shared is for educational and informational purposes only and should not be considered financial advice. Investing involves risk, including the possible loss of capital. While risks can sometimes be managed, all investment decisions are your sole responsibility. Always conduct your own research before making any financial decisions. We are simply sharing opinions and educational material with no guarantee of profits or protection from losses.