Markets pulled back this week, led by tech, as valuation concerns grow. A weakening labor market and lingering US shutdown weighed further on sentiment. Here’s everything you need to know and more.

☹️ Layoffs rise sharply

💰 Musk secures $1T comp plan

💊 Pfizer wins Metsera race

💸 Palantir revenue surges

🐻 Bitcoin nears bear market

Read on below.

📈 Markets Snapshot

Contents

⌛ Last Week’s Recap

All three major indices ended the week lower, with the tech-heavy Nasdaq leading the decline. Despite solid tech company earnings, massive AI infra spending and a wave of OpenAI partnerships are fuelling bubble concerns. Investors are also fretting over a weakening job market, dominated by weekly layoff announcements from firms. Meanwhile, Bitcoin teetered on the edge of a bear market, and gold held steady.

Key Takeaways

Job cuts surge 183% month-over-month in Oct: Challenger reported 153K layoffs, the highest for any October since 2003. Despite the jump, ADP’s recent job gains data somewhat helped temper concerns about a sharp labor market deterioration.

China orders state data centers to drop foreign AI chips: Reports emerge that projects under 30% complete are instructed to replace Nvidia and other foreign chips with domestic ones, a move that could boost local players like Huawei, Cambricon, MetaX, and Enflame.

Kimberly-Clark to acquire Kenvue for $48.7B: The cash-and-stock deal values Kenvue at $21.01 a share and aims to close in 2H26, barring disruptions from activist investors.

Starbucks offloads majority China stake: Starbucks will sell 60% of its China operations to Boyu Capital for $4B, creating a joint venture with licensing payments to Starbucks.

White House strikes GLP-1 pricing deal with Lilly and Novo: To slash GLP-1 drug prices for Medicare, Medicaid, and cash payers to $149–$350 per month.

Pfizer to acquire Metsera for up to $10B: Pfizer will buy Metsera for $65.60 per share plus up to $20.65 in CVRs, beating Novo Nordisk’s competing offer after FTC concerns over antitrust and payout risks.

TSMC to hike chip prices for 4 straight years: Starting 2026, TSMC will raise prices by 3–5% annually across its 5nm to 2nm nodes. AI and high-performance chips could see steeper hikes of nearly 10%.

Apple to power Siri with Google’s Gemini AI: Apple will reportedly use Google’s Gemini model to upgrade Siri, expected in Q1 2026. The custom version will run privately on Apple’s servers.

AWS and OpenAI sign $38B multi-year partnership: The 7-year deal gives OpenAI access to massive GPU capacity on AWS to train next-gen models. Full rollout expected by late 2026 as both expand AI compute infrastructure.

Tesla shareholders approve Musk’s pay plan: The new comp package could grant Elon Musk control of over 25% of Tesla if milestones are met. The plan is tied to an $8.5 T market cap target over 10 years and faced opposition from some large shareholders and advisers

Palantir delivers strong growth, but falls -11% due to valuation concerns: Its Q3 revenue rose 63% YoY to $1.18B, led by explosive 121% growth in US commercial and 52% growth in US govt revenue. EPS came in at $0.21, well above estimates.

Uber earnings beat, but underlying profits disappoint: EPS came in at $3.11 vs. $0.69 est., boosted by one-time tax and investment gains. Core operating income missed forecasts, despite 19% revenue growth.

AMD posts record Q3 results and strong outlook: Revenue rose 36% YoY to $9.25B, with solid data center and gaming growth. CEO Lisa Su said Q4 marks a “clear step up” as AI and compute demand accelerate.

Economic Data Recap

↗️ Higher than previous period

↘️ Lower than previous period

|

Notable Earnings Recap

| Company | Qtr Rev |

Qtr EPS |

YTD |

|---|---|---|---|

| Palantir (PLTR) |

$1.18B

|

$0.21

|

+135% |

| Shopify (SHOP) |

$2.68B

|

$0.69

|

+43% |

| Uber (UBER) |

$13.47B

|

$3.11

|

+53% |

| AMD (AMD) |

$9.25B

|

$1.20

|

+93% |

| Arista Networks (ANET) |

$2.21B

|

$0.75

|

+22% |

| Novo Nordisk (NVO) |

$11.52B

|

$0.69

|

-47% |

| McDonald's (MCD) |

$7.08B

|

$3.22

|

+3% |

| Qualcomm (QCOM) |

$11.27B

|

$3.00

|

+11% |

| AstraZaneca (AZN) |

$14.46B

|

$1.09

|

+29% |

| Constellation Energy (CEG) |

$6.57B

|

$3.04

|

+60% |

🔦 Weekly Spotlight

Special Purpose Vehicles (SPVs)

🗓️ The Week Ahead

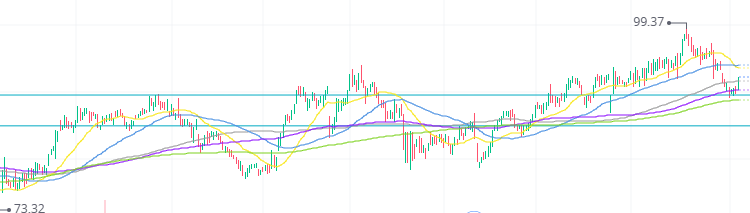

An intraday recovery during Friday’s trading session pushed the S&P 500 and Nasdaq 100 back above their 50-day moving averages, a key technical level. The coming week will be key in seeing if a rebound back to highs can continue, or if we drop below this level and see further downside. With the US government shutdown updates, labor market developments, earnings, and Fed commentary all on deck, we could have a number of catalysts moving markets in either direction next week.

US Government Shutdown: Negotitations will continue, as the stalemate enters its 6th week. Senate Majority Leader John Thune rejected a Democratic proposal to reopen the government in exchange for a one-year extension of ACA tax credits, calling it a “nonstarter.”

Consumer Price Index Report (Thu, 13 Nov): If the shutdown ends, the October CPI will offer a crucial read on inflation and could sway expectations for future Fed moves.

Retail Sales & PPI (Fri, 14 Nov): Also contingent on government reopening, these reports will shed light on consumer strength and producer-level inflation.

CoreWeave Earnings (Mon, 10 Nov, AMC): Focus will be on AI infra demand, capacity expansion, and guidance.

Cisco Earnings (Wed, 12 Nov, AMC): Focus will be on networking hardware growth, particularly for the data center segment.

Upcoming Notable Earnings

🎯 This Week’s Pick

Medtronic

| Market Cap | P/E | Fwd P/E | YTD |

|---|---|---|---|

| $118B | 25.46 | 15.17 | +15.42% |

MDT Daily Chart

Profile

Medtronic is one of the world’s largest medical technology companies, specializing in devices and therapies for cardiovascular, diabetes, neurological, and surgical conditions. With operations across 150+ countries, Medtronic serves hospitals and clinics worldwide through innovation-driven products like pacemakers, insulin pumps, and robotic-assisted surgery systems. As a Dividend Aristocrat, it has raised its dividend for 48 consecutive years, reflecting a strong commitment to shareholder returns and consistent cash generation.

Fundamental Overview

Medtronic’s growth has faced challenges in recent years due to slower procedure volumes and regulatory delays, but performance has improved in recent quarters thanks to steady demand recovery and new product launches. The company generates over $33B in annual revenue with non-GAAP operating margins near 25%, supported by robust free cash flow of ~$5B annually. Its balance sheet is healthy, providing flexibility for R&D and acquisitions. However, ongoing margin pressure from higher input costs and product mix, coupled with foreign exchange headwinds, continues to weigh on results.

Technical Overview

Medtronic’s chart is an interesting bullish set up for a confluence of three reasons.

It recently pulled back, and bounced-off a key demand zone of $89.5, which also happens to sit just above its 200-day moving average

Its daily RSI is rebounding from an oversold level

Zooming out, it has formed a cup-and-handle pattern, a classic bullish formation

A medium-term target is in the $100–$105 range if bullish momentum continues

🚀 Future Play

Astera Labs

| Market Cap | P/E | Fwd P/E | YTD |

|---|---|---|---|

| $28B | 147.35 | 70.00 | +24.95% |

Profile

Astera Labs is an AI infrastructure semiconductor company specializing in high-speed connectivity solutions that link GPUs, CPUs, and accelerators inside data centers. Founded in 2017, it designs critical components for cloud and AI systems such as PCIe retimers, Ethernet connectivity chips, and CXL-based memory solutions. The company is benefiting from the rapid global build-out of data centers, positioning itself as a key enabler of next-gen computing performance.

Competitive Advantage

Astera’s strength lies in its deep integration with hyperscalers and chipmakers like AMD, Intel, and NVIDIA. Its products address bottlenecks in AI workloads by improving bandwidth efficiency and latency across servers. With gross margins near 76% and a growing portfolio of connectivity solutions under its Leo, Taurus, and Aries platforms, Astera has established a reputation for innovation in a niche but expanding segment. Its fabless model allows it to remain asset-light while scaling rapidly with partners in the semiconductor supply chain.

Fundamental Overview

Astera has shown impressive growth since going public, with FY2025 revenue now projected to exceed $780M. Profitability has improved rapidly, with non-GAAP operating margins hitting ~42% in Q3 2025. Its balance sheet is strong, holding ~$1B in cash and minimal debt, giving it flexibility to invest in R&D and aquisitions such as its recent agreement to acquire aiXscale Photonics, which will expand its reach into optical interconnects. However, while growth is robust, its elevated earnings multiple gives it very little margin for error.

Risks & Considerations

The company’s heavy exposure to a few hyperscale clients poses the threat of concentration risk if AI capital expenditures slow. It also faces competition from both established chipmakers like Marvell, Broadcom, and Nvidia, and emerging CXL and interconnect specialists such as Rambus and Alphawave. While Astera has proven itself a high-quality player in the AI ecosystem, its ability to sustain execution and deliver strong earnings growth in the coming quarters will need to be exceptional for the company to grow into its current valuation.

👋🏼 About The Author

Ali Husain

Ali is a full-time equity trader and investor based in Dubai, and the founder of First Mile Investing. He left his corporate career in 2024 to pursue his passion for the markets. He founded First Mile Investing to help beginners take their first confident steps into investing, with the goal of making the process less intimidating, more accessible, and empowering for everyone.

Know someone who might find this newsletter useful?

Or reach out to us at [email protected] if you have some feedback.

Ready to take the next step in your investing journey?

At First Mile Investing, we walk you through the basics of account setup and portfolio building so you feel confident making your own informed investing decisions.

Shoppers are adding to cart for the holidays

Over the next year, Roku predicts that 100% of the streaming audience will see ads. For growth marketers in 2026, CTV will remain an important “safe space” as AI creates widespread disruption in the search and social channels. Plus, easier access to self-serve CTV ad buying tools and targeting options will lead to a surge in locally-targeted streaming campaigns.

Read our guide to find out why growth marketers should make sure CTV is part of their 2026 media mix.

Copyright Notice

All content, analysis, and visuals in Markets Weekly are the intellectual property of the author. Unauthorized copying, distribution, or reproduction of this newsletter, including its images, ideas, and research, is strictly prohibited without prior written consent.

Disclaimer

The weekly newsletters are not trade alerts or recommendations to buy or sell any securities. First Mile Investing is not a licensed financial advisor. The information shared is for educational and informational purposes only and should not be considered financial advice. Investing involves risk, including the possible loss of capital. While risks can sometimes be managed, all investment decisions are your sole responsibility. Always conduct your own research before making any financial decisions. We are simply sharing opinions and educational material with no guarantee of profits or protection from losses.