Welcome to Markets Weekly! The S&P 500 closed the week at a new record high thanks to robust company earnings, cooler than expected inflation, and US-China tensions tapering down. Here’s everything you need to know and more.

💸 Earnings strength continues

✅ Inflation lower than forecast

🪙 Gold takes a breather

📺 Netflix earnings chill

⛔ US shutdown drags on

Read on below.

📢 Reader’s Voice

"Back in the day I used to invest without a clear strategy, and buy high and sell low. First Mile has helped me cancel the noise, focus on fundamentals, stay disciplined, and generate decent alpha for myself"

- Pritesh Kamani, Bain & Company, Dubai

Have insights or feedback? Reply with your thoughts for a chance to be featured to 1K+ readers

📈 Last Week’s Recap

Markets ended the week on a high note, as a cooler-than-expected inflation report pushed major indices to new record highs. Gains were broad, led by tech, industrials, healthcare, and biotech. Precious metals paused their rally. Gold and silver fell 3% and 6%, respectively, while crude oil rebounded nearly 8%.

|

Key Takeaways

S&P 500 company earnings continue to outperform : 84% of companies have beaten earnings expectations so far, on track for the best performance since Q2 2021.

Inflation although trending up, comes in lower than expected : CPI rose to 3% YoY in Sep, the first time at or above this level since January, but the reading was cooler than the expected 3.1%, which will ease pressure on the Fed.

China GDP grows 4.8% YoY in Q3, lower than 5.2% YoY in Q2 : Fixed-asset and property investments declined, however, industrial production and retail sales rose.

US-India trade deal imminent : Deal to cut tariffs on Indian exports to ~15%, and contingent on India slashing Russian oil imports, and opening up access to US agricultural exports to India.

Trump announces 10% tariff increase on Canada via Truth Social : Posted on Saturday, for Canada allegedly running a "fraudulent" advertisement misrepresenting Ronald Reagan's views on tariffs.

South Korea to bolster defense spending : President Lee Jae Myung aims to expand defense and aerospace research through 2030 to build the world’s 4th largest defense industry.

US to unlock plutonium fuel for nuclear firms : The DOE will allow companies to apply for weapons-grade plutonium from Cold War stockpiles for conversion into advanced reactor fuel, aiming to reduce dependence on Russian uranium.

CBOE eyes extending options trading hours : Looking to add a pre-market session from 7.30-9.25am ET and after hours from 4.00-4.15pm ET.

Applovin hit by federal and state data-privacy probe : Accusations involve tracking users, including kids, with digital fingerprints and showing inappropriate ads. APP denies the claims.

Amazon to automate up to 75% of its US operations : Potentially cutting 160k jobs by 2027, and replacing over 600K jobs by 2033.

Google unveils quantum computing breakthrough : Their new “Quantum Echoes” algorithm, run on the Willow Chip, solves problems 13,000X faster than the world’s fastest supercomputer.

Antropic signs major cloud deal with Google : To expand capacity up to 1 million TPUs, and other services for future Claude models, worth tens of billions of dollars.

Baidu to launch Europe's first commercial robotaxi in December : Its ride-hailing arm, Apollo Go, to partner with PostBus, and will debut in eastern Switzerland.

Barclays posts strong Q3 earnings, lifts 2025 outlook : The bank also announced quarterly share buybacks, starting with $500M this quarter.

Netflix drops on surprise earnings miss : Although guidance and ad metrics came in strong. NFLX blamed the earnings miss on an expense related to a dispute with Brazilian tax authorities.

Tesla Q3 earnings show margin pressure : Revenue beat estimates, but earnings and gross margins came in lower than expected. However, Elon Musk’s updates on its AI build-out, Robotaxi, and Optimus gave investors reasons for optimism.

Economic Data Recap

↗️ Higher than previous period

↘️ Lower than previous period

|

Notable Earnings Recap

| Company | Qtr Rev |

Qtr EPS |

YTD |

|---|---|---|---|

| General Electric (GE) |

$11.30B

|

$1.66

|

+82% |

| Coca Cola (KO) |

$12.41B

|

$0.82

|

+12% |

| Netflix (NFLX) |

$11.51B

|

$5.87

|

+23% |

| AT&T (T) |

$30.71B

|

$0.54

|

+10% |

| Tesla (TSLA) |

$28.10B

|

$0.50

|

+7% |

| IBM (IBM) |

$16.33B

|

$2.65

|

+40% |

| Intel (INTC) |

$13.65B

|

$0.23

|

+91% |

| Proctor & Gamble (PG) |

$22.39B

|

$1.99

|

-9% |

🔦 Weekly Spotlight

Rare Earth Elements - Digging Deeper

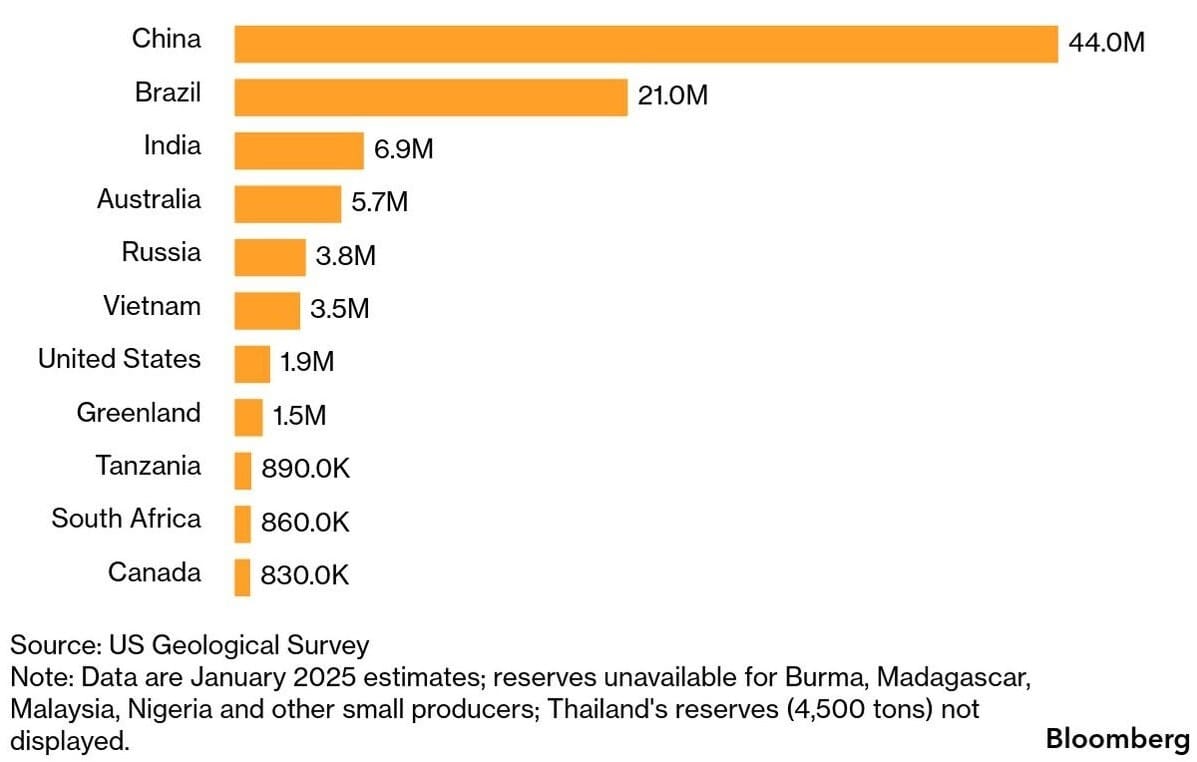

Rare Earth Reserves In Metric Tons

Rare earth elements (REEs) are back in the headlines in recent weeks after China’s tightening of export controls, reigniting US-China trade tensions and fueling a global scramble to secure supply chains.

In parallel, it has ignited another rush into REE and related stocks, with the VanEck Rare Earth & Strategic Metals ETF (REMX) up ~90% YTD.

What Are They?

REEs are a group of 17 chemically similar elements (eg. Neodymium, Dysprosium) that are a subset of the periodic table. Despite the name, they are not actually rare, and are found commonly in the Earth’s crust.

However, they are rarely concentrated enough to make extraction economically viable, and the process is cumbersome, expensive and generates signficant environmental waste.

Key Applications

REEs are foundational for nearly all modern high-tech and defense sectors. Here are some examples.

Magnets (Neodymium, Dysprosium) : EV motors, turbines, robotics, consumer electronics

Defense & Aerospace : Guidance systems, radar, jet-engine alloys

Electronics & Optics : Screens, lasers, fiber optics, imaging

Industrial Catalysts : Petroleum refining, SMR components, advanced batteries

Why China Has A Monopoly

China now accounts for over 90% of global rare earth refining and processing capacity, giving it strategic leverage over the rest of the world. For decades, developed nations avoided this industry because the process is highly polluting and involves complex separation technology. China accepted these environmental costs, and invested early in building refining capabilities.

International Response

Other nations are aggressively building secure, independent supply chains to safeguard their industries.

International Alliances : The US and Australia signed a major $8.5B mineral deal to secure the flow of 30 critical metals, including rare earths, to the US. Canada, India and Brazil are also rapidly boosting mining

Domestic US Investments : The DOD will invest over $400M into MP Materials (MP) to accelerate the build out of rare earth magnet supply chains and reduce foreign dependency

EU/Japan Response : The EU passed the Critical Raw Materials Act in 2024 to secure supply, and Japan is investing in overseas refiners (like Australia’s Lynas) to diversify away from China

🗓️ The Week Ahead

The week ahead is poised to be one of the most significant of the quarter, dominated by three major events. First, the peak of the Q3 earnings season, with reports from five of the seven “Magnificent Seven”. Second, the Federal Reserve's FOMC decision and commentary from Chairman Powell, where the market is currently pricing in a 98% chance of a 25 basis point rate cut. And third, key global trade talks and developments, particularly those involving the US and China.

Trump meeting with new Japan PM Takaichi : In Tokyo, to discuss trade, investments in the US, and tariffs.

Trump - Xi meeting : On the sidelines of the APEC summit in South Korea. Markets will watch closely for a de-escalation of retaliatory trade measures, and a potential extension of the 01-Nov tariff deadline.

FOMC rate decision and Chair Powell press conference : Wed, 28-Oct. The Fed is widely expected to deliver a 25 bps rate cut, with Powell’s comments on inflation, the labor market and data disruption due to the shutdown on watch.

Magnificent 7 earnings - Microsoft, Alphabet, Meta, Apple and Amazon : Wed, 29-Oct to Thurs, 30-Oct. Together they represent nearly 25% of the S&P 500, making their results pivotal for the broader market.

Upcoming Economic Data Releases

(subject to Govt shutdown ending)

| Report | Period | Date | Med Fcst |

|---|---|---|---|

| Consumer Confidence | Oct | 28-Oct | 94.0 |

| FOMC Rate Decision | Oct | 29-Oct | -0.25% |

| GDP | Q3 | 30-Oct | 2.8% |

| PCE YoY | Oct | 31-Oct | - |

| Core PCE YoY | Oct | 31-Oct | - |

Upcoming Notable Earnings

🎯 This Week’s Pick

Procter & Gamble

| Market Cap | P/E | Fwd P/E | YTD |

|---|---|---|---|

| $357B | 22.26 | 20.61 | -9.04% |

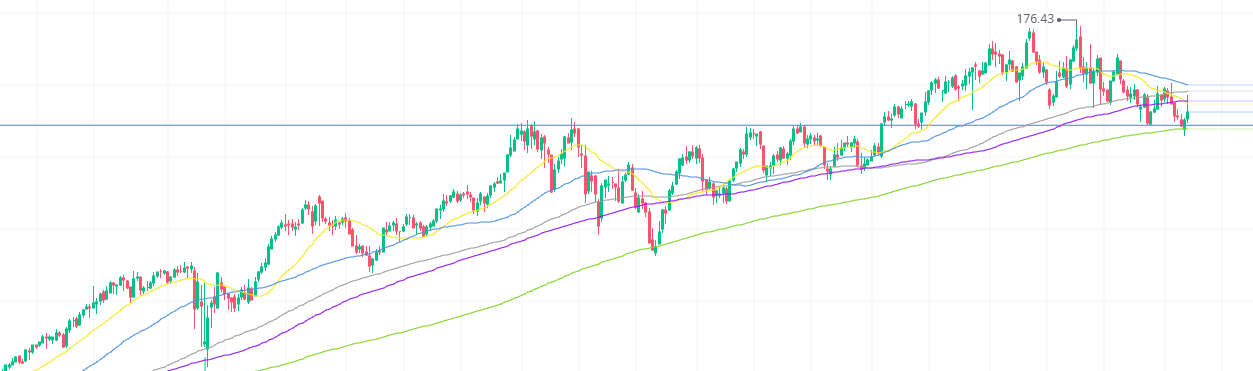

PG Weekly Chart

Profile

Ever heard of Tide, Pampers, Gillette and Oral-B? These are just a few of the iconic, billion-dollar brands under Consumer Packaged Goods (CPG) giant Procter & Gamble. P&G is the largest consumer staples company in the world, and serves consumers globally across 70+ countries, focusing on essential, daily-use categories. Through superior product performance, innovation, and unmatched distribution, P&G brands have become household names across the world and driven strong brand loyalty.

Fundamental Overview

P&G is prized for its stability. Its revenue has slowed to a 3% CAGR since 2022, but it has grown its earnings and operating cash consistently. Although its balance sheet can be stronger, P&G holds nearly $9.6B in cash. Its most recent earnings, released last week, it reassured investors, by reporting an earnings beat, 2% organic sales growth and maintained outlook. The main challenge is persistent margin pressure. However, management expects that applying AI to distribution, marketing and other facets of the business, will boost margins and earnings in the coming quarters.

Technical Overview

P&G currently sits just above a key, multi-year support level of $149. More importantly, when zooming out to the weekly chart, it sits right above its 200-week moving average, a level it has tested and bounced off numerous times since 2015. While it may not be a high-flying, exciting tech name, P&G can be a valuable defensive player in your portfolio when the broader market starts to look shaky, and capital rotates towards safety.

🚀 Future Play

Ardent Health

| Market Cap | P/E | Fwd P/E | YTD |

|---|---|---|---|

| $2.18B | 8.50 | 7.80 | -10.95% |

Profile

Ardent Health Services is a leading US hospital operator specializing in acute care services across six states, primarily focusing on mid-size urban communities. The company operates a network of 30 hospitals and over 280 sites of care. By focusing on essential, non-discretionary healthcare (such as emergency care, maternity, and critical surgery), Ardent benefits from strong, stable secular demand in the domestic healthcare sector.

Competitive Advantage

Ardent’s key advantage is its Joint Venture model. It partners with major academic and non-profit medical centers (like UT Health East Texas), which provides Ardent with local brand loyalty and enhanced patient networks while retaining operational control. This model reduces acquisition risk and provides reliable patient volume. Furthermore, its focus on mid-size, high-growth urban markets and a financially flexible, asset-light structure (leasing many facilities) allows it to quickly pursue strategic acquisitions and focus on operational efficiency.

Fundamental Overview

Ardent Health is growing its top and bottom-line at a respectable pace, with revenue up 12% YoY in Q2 2025, and EBITDA up 39%. It is making strides towards bolstering its balance sheet, with Lease-Adjusted Net Leverage (total debt plus the value of its long-term operating lease payments, relative to its EBITDA) down to 2.7X from 4X a year earlier. However, operating cash flow remained flat YoY, and the company faces headwinds from persistent insurance payer claim denials and the future risk of Medicaid funding cuts.

Risks & Considerations

Its primary risk is the sector being inherently exposed to reimbursement risk from both government (Medicare/Medicaid) and commercial payers, which can impact both earnings and cash flows. While its JV model provides stability, integration risk remains a factor with every new acquisition. Lastly, the company operates in a sector susceptible to rising labor and supply costs, which could quickly reverse recent margin improvements if inflation pressures return.

👋🏼 About The Author

Ali Husain

Ali is a full-time equity trader and investor based in Dubai, and the founder of First Mile Investing. He left his corporate career in 2024 to pursue his passion for the markets. He founded First Mile Investing to help beginners take their first confident steps into investing, with the goal of making the process less intimidating, more accessible, and empowering for everyone.

Know someone who might find this newsletter useful?

Or reach out to us at [email protected] if you have some feedback.

Ready to take the next step in your investing journey?

At First Mile Investing, we walk you through the basics of account setup and portfolio building so you feel confident making your own informed investing decisions.

Copyright Notice

All content, analysis, and visuals in Markets Weekly are the intellectual property of the author. Unauthorized copying, distribution, or reproduction of this newsletter, including its images, ideas, and research, is strictly prohibited without prior written consent.

Disclaimer

The weekly newsletters are not trade alerts or recommendations to buy or sell any securities. First Mile Investing is not a licensed financial advisor. The information shared is for educational and informational purposes only and should not be considered financial advice. Investing involves risk, including the possible loss of capital. While risks can sometimes be managed, all investment decisions are your sole responsibility. Always conduct your own research before making any financial decisions. We are simply sharing opinions and educational material with no guarantee of profits or protection from losses.