Welcome to Markets Weekly! Markets held steady after a turblent start to October, despite trade tensions, the ongoing US govt shutdown, and jitters in the regional banking sector. Here’s everything you need to know and more.

👻 US-China tensions persist

💰 Big banks report strong earnings

⚠️ Regional banks show cracks

🩶 Silver hits record highs

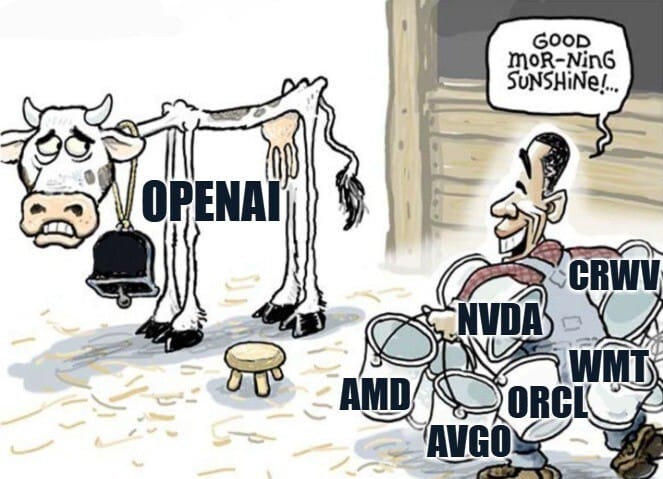

🤖 AI infra deals accelerate

✨ TSMC flexes its forecast

📉 Crypto drops sharply

Read on below.

📢 Reader’s Voice

"This newsletter is my go-to source for all the market updates I need in one place. I don’t always have time to read everything individually, so having it summarized and easy to understand is awesome. It’s educational, well-written and has helped me make more informed investment decisions"

- Sanjana Chimnani, Raine & Horne, Dubai

Have insights or feedback? Reply with your thoughts for a chance to be featured to 1K+ readers

Contents

📈 Last Week’s Recap

Despite the volatility, the major indices closed higher after commentary from President Trump signaled optimism about striking a trade deal. The VIX (the market’s fear gauge) dropped sharply on Friday from a high of 29.

Precious metals continued their insane melt-up but took a breather on Friday, while Crude Oil dropped below $60 a barrel. Finally, AI infrastructure deals continued to accelerate, driven by OpenAI and other tech giants, shaking off bubble concerns.

|

Key Takeaways

US Govt shutdown crosses day 18 : Becoming the third-longest in history. Thousands of federal works have been furloughed, and key economic data releases are postponed until the reopening.

China defends rare-earth export rules : Beijing said its export controls comply with trade law and warned it will “fight the trade war to the end.”

China targets US subsidiaries : Beijing restricted five US units of Hanwha Ocean and launched a shipping tariff probe, raising tension in US–China trade relations.

Trump warns China on soybeans : Trump accused Beijing of “economic hostility” and threatened bans on Chinese cooking oil imports as retaliation.

US Treasury’s Bessent on China trade : Bessent said Beijing is “trying to backfill its narrative” on rare earth controls but that Washington has “many levers to pull.” Confirmed plans for a Trump-Xi meeting are under way.

Small-business optimism drops: The National Federation of Independent Business (NFIB) Index fell in Sep, as costs and shutdown delays hit confidence. 31% of firms plan price hikes next quarter.

Regional bank losses rattle markets : Zions and Western Alliance disclosed major credit losses tied to potential fraud, sparking fears of broader issues. The KRE regional bank ETF closed the week down 1.9%, after posting a recovery on Friday.

Silver hits record high of $54.2 per ounce : As did Gold and Platinum. However, prices did pullback on Friday.

Oracle to deploy 50K AMD AI chips : ORCL will roll out AMD Instinct MI450 GPUs in 2026 to power OpenAI’s $300B cloud and AI infrastructure.

OpenAI–Broadcom partnership : AVGO and OpenAI to co-design 10 GW of AI accelerators combining Broadcom networking with OpenAI chips. AVGO closed the week up 7.6%.

Google to invest $15B in India : GOOGL to build a 1-GW AI and data hub in Andhra Pradesh, its largest outside the US.

AI consortium to buy Aligned Data Centers for $40B : Led by BlackRock, NVIDIA, Microsoft and xAI, with the goal of doubling Aligned’s 50 data center campuses across the Americas.

Walmart integrates ChatGPT to checkout : WMT launched Instant Checkout, which lets users shop through ChatGPT across Walmart and Sam’s Club.

Banking giants JP Morgan, Wells Fargo, Citi, Morgan Stanley and Goldman Sachs post strong Q3 earnings : Driven by dealmaking, robust credit portfolio performance and resilience in retail banking.

As does chip giant TSMC : TSM revenue rose 37% YoY to $32.2B and EPS hit $2.84, beating estimates on strong AI-chip demand. It expects its AI-related revenue to grow at a 45% CAGR through 2030.

Economic Data Recap

No notable releases due to ongoing US Govt shutdown : US Retail Sales, Producer Price Index (PPI) and Housing Starts, among others, were due to be released this week.

Notable Earnings Recap

| Company | Qtr Rev |

Qtr EPS |

YTD |

|---|---|---|---|

| JP Morgan (JPM) |

$46.42B

|

$5.07

|

+24% |

| J&J (JNJ) |

$23.99B

|

$2.80

|

+34% |

| Goldman Sachs (GS) |

$15.18B

|

$12.25

|

+31% |

| ASML (ASML) |

$8.73B

|

$6.38

|

+49% |

| Bank Of America (BAC) |

$28.09B

|

$1.06

|

+17% |

| Taiwan Semiconductor (TSM) |

$32.27B

|

$2.84

|

+49% |

| American Express (AXP) |

$18.43B

|

$4.14

|

+17% |

🔦 Weekly Spotlight

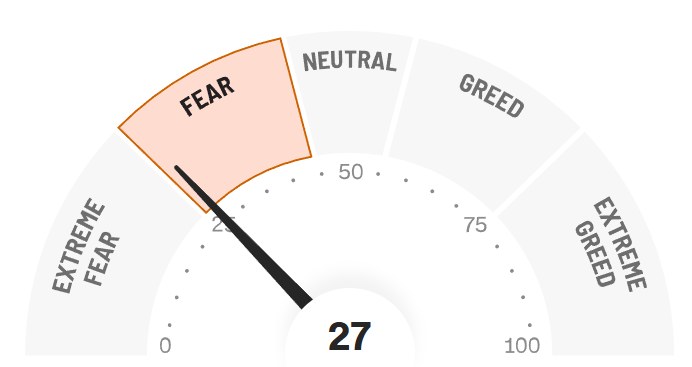

How The Fear & Greed Index Works

As of 17-Oct-2025

What It Is

The Fear & Greed Index, developed by CNN, measures sentiment in the US stock market, ranging from 0 (Extreme Fear) to 100 (Extreme Greed). It is based on the idea that excessive fear pushes prices below fair value, while excessive greed drives them too high.

How It Is Calculated

The index draws from seven distinct market-based indicators, all sourced from US financial data providers like the NYSE and CBOE. Each indicator is given an equal weighting of 14.3%.

Stock Price Momentum : Tracks the S&P 500's price relative to its 125-day moving average. Above average signals greed (bullish trend). Below indicates fear (waning confidence).

Stock Price Strength : Tracks the number of stocks on the NYSE at 52-week highs versus those at 52-week lows.

Stock Price Breadth : Measures the volume of shares on the NYSE that are rising versus the number of shares that are falling. High advancing volume indicates greed, and a low or negative number indicates fear.

Put & Call Options : Looks at the put/call ratio. A ratio above 1 is considered bearish, while a lower ratio indicates greed or speculation.

Market Volatility : Measured by the most well-known CBOE Volatility Index or VIX. The VIX measures expected S&P 500 volatility over the next 30 days by averaging prices of its options contracts.

Safe Haven Demand : Compares returns of stocks versus treasury bonds. Bonds outperforming signals fear.

Junk Bond Demand : Gauges spreads between investment-grade and high-yield (junk) bonds. Widening spreads indicates fear, and narrowing spreads indicates greed.

Uses & Caveats

The Index is used by investors as a tool to gauge sentiment extremes and identify potential turning points. Extreme fear often coincides with market troughs, while extreme greed coincides with market tops and an imminent pull-back or correction.

However, the index should not be considered in isolation as it lags rapid market shifts, oversimplifies weighting, and focuses narrowly on US equities, requiring use with fundamentals and other technical indicators. For example, today, the index reads 27 (fear), even as the S&P 500 sits just ~1.5% below record highs.

🗓️ The Week Ahead

Next week will be dominated by updates on the government shutdown, trade commentary, and ongoing talks between the US and China, as we officially enter the thick of earnings season. The S&P and Dow sit just below their 21-day moving averages.

Mixed earnings and market jitters could push indices to retest their 50-day averages, while robust earnings and positive trade catalysts could send us back to All-Time Highs. Oil prices, precious metals, and bond yields will also be on watch.

US Treasury Secretary Scott Bessent’s meeting with China’s Vice Premier He Lifeng in Malaysia. Trade talks and de-escalating tensions will be key.

Netflix (NFLX) earnings : Tues, 21-Oct, AMC. Focus on subscriber growth, ad-supported tier success, and free cash flow generation.

Tesla (TSLA) earnings : Wed, 22-Oct, AMC. Investors will scrutinize auto gross margins after record deliveries were achieved due to EV credits expiring and pricing cuts. Commentary on new models, robo-taxi progress and optimus updates will be key.

Intel (INTC) earnings : Thur, 23-Oct, AMC. Focus on the performance of the Data Center segment, progress on the foundry business, and “AI PC” updates.

Upcoming Economic Data Releases

(subject to Govt shutdown ending)

US Existing Home Sales : Thurs, 23-Oct

Existing Home Sales measures the monthly sales of previously owned homes, a key gauge of housing demand in the secondary market.US New Home Sales : Fri, 24-Oct

New Home Sales tracks the monthly purchases of newly built homes.US CPI & Core CPI inflation : Fri, 24-Oct

CPI : Consumer Price Index tracks prices households pay for a basket of goods and services. Core CPI excludes food & energyUMich Consumer Sentiment : Fri, 24-Oct

Consumer Sentiment measures consumer confidence in the US economy via surveys. Above 80 indicates optimism, while below 70 indicates rising pessimism.

Upcoming Notable Earnings

🎯 This Week’s Pick

Lennar Corp

| Market Cap | P/E | Fwd P/E | YTD |

|---|---|---|---|

| $31.82B | 12.43 | 14.16 | -3.98% |

Profile

Lennar Corp is one of the largest homebuilders in the US, operating across 26 states. It is vertically integrated, offering single-family homes across multiple price points, mortgage financing, and title services. The company has accelerated its long-standing strategic goal of becoming an "asset-light, land-light" manufacturer of homes. This pivot involved the spin-off of a significant portion of its land holdings into a separate entity (Millrose Properties in Feb 2025) to reduce financial risk and focus entirely on home manufacturing.

Fundamental Overview

Although Lennar’s annual revenue has been growing at a tepid 9% CAGR over 3 years due to affordability constraints, its business is backed by one of the sector's strongest balance sheets, with a current ratio of 4.51 and debt-to-capital ratio well below 15%. The stock trades at an attractive 12.4 P/E. Elevated mortgage rates in recent years have forced the company to use pricing incentives and compress margins to sell inventory. This pressure should ease as mortgage rates are projected to fall in 2026, which is expected to boost sales as more buyers enter a tight housing market.

Technical Overview

Homebuilder stocks, including Lennar, received a shot in the arm in August from the prospect of falling interest rates, after struggling through a downward trend for most of 2025. This brief rally pushed Lennar above its 120-day and 200-day moving averages, though it has since corrected back and now sits just above that support. Prospects of rates lowering further, and a technical shift from a downtrend to an uptrend, could see the stock retest its key resistance level of $144.

🚀 Future Play

Nu Holdings

| Market Cap | P/E | Fwd P/E | YTD |

|---|---|---|---|

| $72.28B | 31.93 | 22.40 | +44.80% |

Profile

Nu Holdings is a Brazilian digital banking giant revolutionizing finance across Latin America. It provides low-cost, mobile-first banking services through a simple, user-friendly app. Founded in 2013, the company now serves over 120 million customers across Brazil, Mexico, and Colombia, making it one of the largest fintechs globally. By eliminating traditional banking inefficiencies and fees, Nu has become a financial gateway for millions of underbanked Latin Americans. It plans to enter the US market in the near future.

Competitive Advantage

Nu’s strength lies in its technology-first, low-cost business model and powerful brand trust. With one of the most downloaded banking apps in the world, it uses real-time data and machine learning to underwrite loans, manage risk, and personalize products far faster than legacy banks. Its operating cost per customer is just a fraction of traditional institutions like Itaú or Bradesco. The company’s viral marketing, seamless UX, and community-based customer service have created extraordinary loyalty.

Fundamental Overview

Nu is showing a rare blend of hypergrowth and profitability. In Q2 2025, it reported $3.7B in revenue (up 29% YoY) and net income of $637M, marking its sixth consecutive profitable quarter. Customer deposits surpassed $36B, while the loan book reached $27B, driven by strong adoption of personal loans and SME credit. Return on Equity hit 28%, well above most global neobanks. Its capital-light model allows high scalability, and with a cost-to-income ratio near 30%, Nu stands among the most efficient financial platforms worldwide.

Risks & Considerations

Nu’s rapid expansion exposes it to macroeconomic volatility in Latin America, where inflation, regulation, and currency swings can quickly affect consumer credit quality. Its growing loan portfolio increases exposure to defaults if unemployment rises. Additionally, competitors like Mercado Pago and PicPay are expanding aggressively into digital banking, while traditional banks are modernizing faster. As Nu enters new markets, balancing growth with responsible lending and maintaining asset quality will be key to sustaining its valuation.

👋🏼 About The Author

Ali Husain

Ali is a full-time equity trader and investor based in Dubai, and the founder of First Mile Investing. He left his corporate career in 2024 to pursue his passion for the markets. He founded First Mile Investing to help beginners take their first confident steps into investing, with the goal of making the process less intimidating, more accessible, and empowering for everyone.

Know someone who might find this newsletter useful?

Or reach out to us at [email protected] if you have some feedback.

Ready to take the next step in your investing journey?

At First Mile Investing, we walk you through the basics of account setup and portfolio building so you feel confident making your own informed investing decisions.

The Future of the Content Economy

beehiiv started with newsletters. Now, they’re reimagining the entire content economy.

On November 13, beehiiv’s biggest updates ever are dropping at the Winter Release Event.

For the people shaping the next generation of content, community, and media, this is an event you won’t want to miss.

Copyright Notice

All content, analysis, and visuals in Markets Weekly are the intellectual property of the author. Unauthorized copying, distribution, or reproduction of this newsletter, including its images, ideas, and research, is strictly prohibited without prior written consent.

Disclaimer

The weekly newsletters are not trade alerts or recommendations to buy or sell any securities. First Mile Investing is not a licensed financial advisor. The information shared is for educational and informational purposes only and should not be considered financial advice. Investing involves risk, including the possible loss of capital. While risks can sometimes be managed, all investment decisions are your sole responsibility. Always conduct your own research before making any financial decisions. We are simply sharing opinions and educational material with no guarantee of profits or protection from losses.