Welcome to Markets Weekly! We wrapped up the week and month, with major indices sitting just below all-time highs. Despite jitters in recent weeks, nothing has spooked the markets into a meaningful drop or correction. Here’s everything you need to know and more.

⬇️ Fed trims rates further

🤝🏼 US-China call timeout

☁️ Big tech cloud boom continues

🐳 Nvidia hits $5T market cap

☢️ Nuclear deals power up

💰 Berkshire cash pile at $381B

Read on below.

📢 Reader’s Voice

"Since moving to Dubai and no longer building a pension, I’ve started investing my savings. For someone new to this, Ali’s First Mile has been a tremendous help in navigating the complex world of investing, making it not only easier, but genuinely enjoyable"

- Jenny Didrichsen, Wayout Water, Dubai

Have insights or feedback? Reply with your thoughts for a chance to be featured to 1K+ readers

📈 Last Week’s Recap

October saw broad-based gains across major asset classes, with indices repeatedly hitting new highs throughout the month. However, gold and other precious metals pulled back in recent weeks after a historic rally. Bitcoin and crypto remained volatile and ended the month flat, while the dollar regained strength after several months of weakness.

|

Key Takeaways

Federal Reserve cuts interest rates by 25 bps to 3.75-4.00% : Citing uncertainty about the economic outlook, though Chair Powell said that a rate cut in Dec is far from a foregone conclusion.

Trump - Xi meeting leads to temporary trade truce : US tariffs to drop from 57% to 47%. China will immediately buy US soybeans and remove rare-earth export blocks for a year.

US - Japan rare-earth & critical-minerals deal : Trump and Sanae Takaichi sign framework to secure supply chains, coordinate investment and stockpiling.

US backs $80B nuclear reactor deal with Brookfield and Cameco owned Westinghouse : Govt-facilitated financing (aided by Japan) will help build up to eight large-scale nuclear reactors. BEP and CCJ stock closed the week up 4.30% & 16.50% respectively.

Microsoft secures 27% OpenAI stake, plus $250B Azure commitment : The 27% stake is valued at $135B. OpenAI commits to buying $250B in Azure services, and Microsoft's IP rights extend to 2032.

Qualcomm introduces AI servers to compete with Nvidia/AMD : Its new AI200 and AI250 server lineup will use Hexagon NPU tech that supports up to 768 GB of memory, aimed at inference workloads.

Anthropic to double Amazon cloud investment : Committing to 1 million Amazon Trainium 2 chips by year-end.

Google - NextEra Energy partner to restart Duane Arnold nuclear plant : The project aims at restarting the plant in Iowa to supply power to Google to support its massive AI-driven electricity demand, under a 25-year deal.

Nvidia unveils NVQLink to power quantum computing connectivity : CEO Jensen Huang also announced a partnership with Uber to power 100K robotaxis, and a $500B revenue backlog for its advanced chips through 2026.

Nvidia and Samsung announce partnership : To build an AI Megafactory that will deploy 50K+ Nvidia GPUs to power AI across Samsung’s chip design, production and quality control.

Berkshire Hathaway operating profits surge by 33% : Q3 operating profits hit $13.5B, led by strong insurance, railroad, and manufacturing gains. The company was a net seller of $6B in equities, lifting its cash pile to a record $381B

Big Tech Q3 Earnings Highlights

|

|

Microsoft |

|

|

|

|

|

|

|

|

|

Meta |

|

|

|

|

Apple |

|

|

|

|

Amazon |

|

|

Economic Data Recap

↗️ Higher than previous period

↘️ Lower than previous period

|

Notable Earnings Recap

| Company | Qtr Rev |

Qtr EPS |

YTD |

|---|---|---|---|

| UnitedHealth Group (UNH) |

$113.16B

|

$2.92

|

-32% |

| Visa (V) |

$10.70B

|

$2.98

|

+8% |

| Caterpillar (CAT) |

$17.64B

|

$4.95

|

+59% |

| Microsoft (MSFT) |

$77.67B

|

$4.13

|

+23% |

| Alphabet (GOOGL) |

$102.35B

|

$2.87

|

+49% |

| Meta Platforms (META) |

$51.24B

|

$1.05

|

+11% |

| Eli Lilly (LLY) |

$17.60B

|

$7.02

|

+12% |

| Apple (AAPL) |

$102.47B

|

$1.85

|

+8% |

| Amazon (AMZN) |

$180.17B

|

$1.95

|

+11% |

| Exxon Mobil (XOM) |

$85.29B

|

$1.76

|

+6% |

| Berkshire (BRK-B) |

$94.97B

|

$6.25

|

+5% |

🔦 Weekly Spotlight

What Does AppLovin Actually Do?

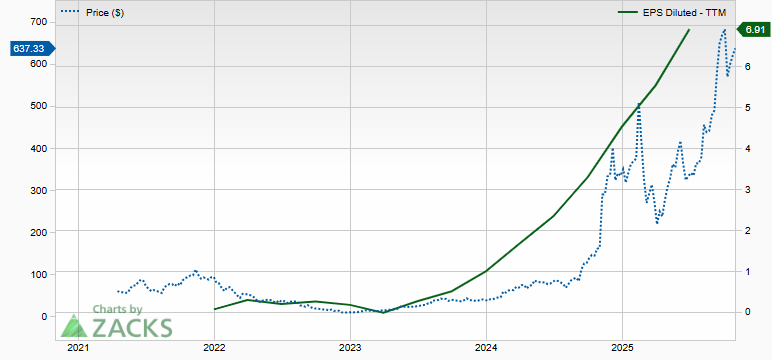

AppLovin (APP) has been one of the market's most explosive stories, with its stock price surging nearly ~3,500% over the last three years, and around ~270% in 2025. Yet, for many, its business remains a mystery. AppLovin’s valuation is no doubt lofty, trading a near 100 P/E. However, that multiple has been backed by phenomenal growth. The company is forecasting a 100%+ EPS growth this year.

$APP : EPS TTM vs Stock Price

What It Does

AppLovin is an AI-driven software platform that provides a full suite of tools to help mobile app developers (like game studios, streaming services, or e-commerce brands) scale their user base and maximize ad revenue.

Core Products

🎯 User Acquisition – AXON

This AI engine analyzes billions of data points to find only the users most likely to download your game, keep playing it, and spend money on in-app purchases.

💰 Ad Monetization – MAX

This platform manages a developer's in-app advertising space. It uses in-app bidding to hold a lightning-fast auction for every ad slot, ensuring the highest-paying ad from thousands of potential demand sources is always displayed.

📊 Data & Analytics – Adjust

The Adjust platform provides developers with transparent data to measure the performance of all ad spend. It offers critical insights on key metrics such as user Lifetime Value (LTV) and Return on Ad Spend (ROAS).

📺 Connected-TV Platform – Wurl

Wurl is a cloud platform that extends AppLovin's reach into the streaming TV market. It connects streaming TV channels with advertisers.

AppLovin has quietly built a vertically integrated ad empire, outcompeting the likes of Google, Unity, and the Trade Desk. However, potential investors must be wary that AppLovin will need to continue reporting exemplary growth metrics in future quarters to justify its lofty valuation. It reports earnings next week on 05-Nov.

🗓️ The Week Ahead

With the US govt shutdown still in effect, official economic releases remain on hold, making private-sector data such as S&P Global PMI, ISM manufacturing and services surveys, and ADP employment reports all the more critical for gauging growth and labor trends.

Meanwhile, earnings season continues in full swing, led by a flurry of high-profile reports from AI and tech names that could set the tone for November’s market momentum.

US Govt Shutdown : Now stretching into its fifth week, the shutdown is on track to become the longest since 2018.

ADP Employment Report (Wed, 5-Nov) : With official labor data frozen, the private ADP payrolls report will be closely scrutinized as a proxy for US job growth and hiring momentum.

Palantir earnings (Mon, 3-Nov) : The company will need to deliver another round of strong growth metrics across both commercial and government segments, to justify its sky-high valuation.

Uber earnings (Tue, 4-Nov): Investors will be looking at how ride-hailing and delivery demand is holding up, and updates on their robotaxi launch.

AMD earnings (Tue, 4-Nov): All eyes will be on data center and AI chip guidance, following major deals signed with OpenAI and Oracle.

Upcoming Economic Data Releases

| Report | Period | Date | Previous |

|---|---|---|---|

| S&P US Mfg PMI | Oct | 03-Nov | 52.2 |

| ISM Mfg | Oct | 03-Nov | 49.1% |

| ADP Employment | Oct | 04-Nov | -32K |

| ISM Services | Oct | 04-Nov | 50.0% |

| *US Non-Farm Payrolls | Oct | 07-Nov | - |

| *US Unemployment Rate | Oct | 07-Nov | - |

Upcoming Notable Earnings

🎯 This Week’s Pick

Progressive Corp

| Market Cap | P/E | Fwd P/E | YTD |

|---|---|---|---|

| $121B | 11.60 | 12.60 | -12.41% |

PGR Weekly Chart

Profile

Progressive Corp is one of the largest property and casualty insurers in the US, best known for its auto insurance business. Founded in 1937, it operates across three main segments : personal insurance (for cars, homes, and RVs), commercial insurance (for businesses and fleets), and property coverage. Progressive is widely recognized as a tech-driven insurance leader. It was among the first to sell policies online and uses advanced data tools like its “Snapshot” program, which tracks driving behavior to offer personalized pricing.

Fundamental Overview

Progressive has shown strong revenue growth in recent years, with annual revenue growing at a ~15% CAGR since 2022. Its earnings have recently been volatile due to pricing pressures and increases in claims. However, the company has an industry-leading combined ratio of 87.8% (an insurer's measure of profitability, showing if premiums cover claims and expenses), a strong balance sheet, and impressive growth in operating cash flow at a ~25% CAGR since 2022. It is the only S&P 500 company to report monthly results, with the next conference call on 04-Nov.

Technical Overview

PGR is currently in an oversold zone, with both its daily and weekly RSI readings below 27. The stock has broken beneath its 50 and 120-week moving averages, signaling a medium-term bearish trend. However, historically, it has found support and reversed near its 120-day weekly moving average, which makes for a contrarian setup for patient investors. This is a medium to long-term opportunity for those willing to hold through weakness to own a high-quality business.

👋🏼 About The Author

Ali Husain

Ali is a full-time equity trader and investor based in Dubai, and the founder of First Mile Investing. He left his corporate career in 2024 to pursue his passion for the markets. He founded First Mile Investing to help beginners take their first confident steps into investing, with the goal of making the process less intimidating, more accessible, and empowering for everyone.

Know someone who might find this newsletter useful?

Or reach out to us at [email protected] if you have some feedback.

Ready to take the next step in your investing journey?

At First Mile Investing, we walk you through the basics of account setup and portfolio building so you feel confident making your own informed investing decisions.

Copyright Notice

All content, analysis, and visuals in Markets Weekly are the intellectual property of the author. Unauthorized copying, distribution, or reproduction of this newsletter, including its images, ideas, and research, is strictly prohibited without prior written consent.

Disclaimer

The weekly newsletters are not trade alerts or recommendations to buy or sell any securities. First Mile Investing is not a licensed financial advisor. The information shared is for educational and informational purposes only and should not be considered financial advice. Investing involves risk, including the possible loss of capital. While risks can sometimes be managed, all investment decisions are your sole responsibility. Always conduct your own research before making any financial decisions. We are simply sharing opinions and educational material with no guarantee of profits or protection from losses.