Welcome to Markets Weekly! Markets shrugged off a US government shutdown and continued to climb as Q4 kicked off. Here’s everything you need to know and more.

🦅 US shutdown drags on

👨🏽💻 Labor market shows more cracks

💊 Pharma gets a shot in the arm

🚢 Freight rates sink

🐼 Chinese stocks continue to surge

🚀 BTC hits new high

Read on below.

📢 Reader’s Voice

"This newsletter is extremely useful for someone with very little time but eager to learn what's happening in the markets. Investing 10 min in reading saves me 2 hours+ of checking business news throughout the week"

- Hernando Flores, McKinsey & Co, Dubai

Have insights or feedback? Reply with your thoughts for a chance to be featured to 1K+ readers

📈 Last Week’s Recap

Markets extended their gains this week, with the Dow and small-cap stocks leading. Pharma, biotech, utilities, and renewables drove most of the upside. Meanwhile, crypto surged, and gold and silver continued their steady climb. Oil prices declined.

|

Key Takeaways

US Govt shutdown continues : Senate failed to pass either party’s funding bills, so the shutdown will stretch into the weekend.

Pfizer deal lifts Big Pharma stocks : Agreement gives Pfizer a three-year tariff exemption and lowers drug prices nation wide. More on it below.

Trump to meet Xi on trade : Leaders will meet in four weeks to discuss trade issues, including soybean purchases and US export controls.

Container freight rates sink to lowest in two years : Due to excess carrier supply, cooling US consumer demand, and tariffs on Asian imports.

Taiwan rejects US chip split : Taiwan flatly refuses to move half of its chip production to the US, calling it "exploitation.

US layoffs highest since 2020 : YTD job cuts reached 946K, dominated by government cuts and AI-related tech layoffs.

And private employment drops sharply : ADP reported a 32K decline in private employment in September, missing the 50K increase expected by analysts.

ADP National Employment Report is a monthly measure of non-farm private employment change in the US, based on actual payroll data from millions of private-sector employees.Chinese stocks extend rally : Supported by policy easing, AI advancements, and renewed institutional inflows. The China large cap ETF, FXI is up 36% YTD.

Berkshire buys Occidental chemical unit : Berkshire to pay $9.7B in cash for the commodity chemicals unit. OXY will use about $6.5B to reduce its debt.

CoreWeave secures Meta deal : AI cloud provider signs a new order agreement with Meta Platforms worth up to $14.2 billion.

Meta to use AI chats to personalize ads : Starting December 16, data from interactions with its gen AI will be used for its ad algorithms.

Fermi debuts on Nasdaq : The AI data-center developer went public this week. It aims to build the world’s largest facility in Texas, and is pre-revenue.

Anthropic introduces Sonnet 4.5 : The new AI model claims to be the best for coding and complex agents, setting a new industry benchmark.

Tesla Q3 deliveries hit record : Deliveries of 497K beat 448K estimates, largely attributed to EV tax credits expiring for consumers. Energy deployment highest ever at 12.5 GWh.

US Government Shutdown 101

What It Is : A government shutdown occurs when Congress fails to pass a funding bill, forcing many federal agencies to temporarily close and suspend operations.

Why It Happens : It usually stems from political gridlock between Congress (House and Senate) and the White House. Typically when Republicans push for spending cuts or policy conditions that Democrats oppose, such as healthcare or social programs.

Economic Impact : Each week of shutdown can shave about 0.1–0.2% off US GDP growth, delay federal paychecks, and freeze major economic reports like jobs and inflation data. Roughly 900K federal employees are furloughed without pay.

Market Reaction : Historically, markets react mildly, with most of the volatility occuring in the lead up. Stocks often stabilize or rise as investors anticipate a resolution will be found.

Economic Data Recap

↗️ Higher than previous period

↘️ Lower than previous period

|

Notable Earnings Recap

| Company | Qtr Rev |

Qtr EPS |

YTD |

|---|---|---|---|

| Carnival Corp (CCL) |

$8.15B

|

$1.43

|

15% |

| Jefferies (JEF) |

$2.05B

|

$1.01

|

-20% |

| Nike (NKE) |

$11.72B

|

$0.49

|

-5% |

🔦 Weekly Spotlight

⚕US Big Pharma - A Closer Look

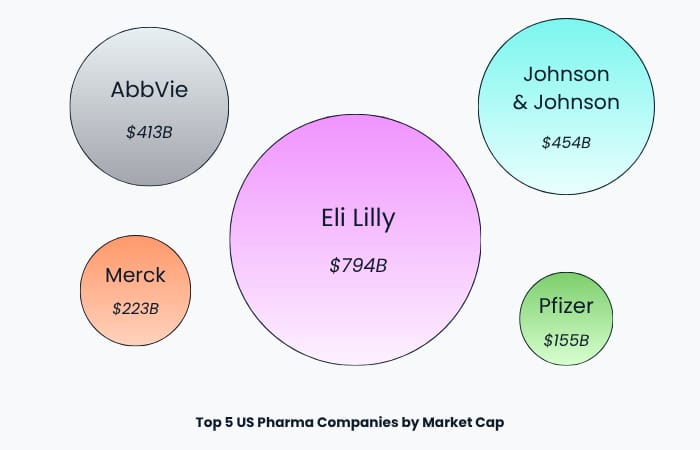

The iShares US Pharma ETF (IHE) closed up over 7.5% this week, led by the big 5, thanks to Pfizer's deal with the admin. The deal will slash drug prices to match developed nations' levels and pledged $70B in US manufacturing/R&D for a 3-year tariff exemption, easing fears of import tariffs on branded drugs and adding policy certainty that also boosted peers.

Here is a closer look at the 5 biggest US pharma stocks :

1. Eli Lilly (LLY)

| Market Cap | Annual Rev (TTM) | Net Profit (TTM) | P/E | |

|---|---|---|---|---|

| $794B | $53B | $14B | 55.7 |

A powerhouse in diabetes, obesity, and neuroscience. Its pipeline is heavy on GLP-1 and Alzheimer’s drugs.

⭐ 💊 Mounjaro/Zepbound (GLP-1 for diabetes/obesity)

2. Johnson & Johnson (JNJ)

| Market Cap | Annual Rev (TTM) | Net Profit (TTM) | P/E | |

|---|---|---|---|---|

| $454B | $91B | $23B | 20.2 |

A diversified leader in immunology, oncology, and neurology. Its pipeline includes novel immune therapies and cancer drugs.

⭐ 💊 Stelara (Immunology)

3. AbbVie (ABBV)

| Market Cap | Annual Rev (TTM) | Net Profit (TTM) | P/E | |

|---|---|---|---|---|

| $413B | $59B | $4B | 111.3 |

Once known for Humira, AbbVie is pivoting to Skyrizi, Rinvoq, neuroscience, and oncology. Its development pipeline spans ~90 programs.

⭐ 💊 Skyrizi & Rinvoq (Immunology)

4. Merck (MRK)

| Market Cap | Annual Rev (TTM) | Net Profit (TTM) | P/E | |

|---|---|---|---|---|

| $223B | $63B | $16B | 13.8 |

An oncology leader anchored by Keytruda. It’s also expanding in vaccines and cardiovascular/metabolic fields, with a broad new pipeline under development.

⭐ 💊 Keytruda (Oncology)

5. Pfizer (PFE)

| Market Cap | Annual Rev (TTM) | Net Profit (TTM) | P/E | |

|---|---|---|---|---|

| $155B | $64B | $11B | 14.6 |

A multi-area pharma focused on vaccines, rare disease, and oncology. Its R&D pipeline includes next-gen vaccines and novel biologics.

⭐ 💊 Prevnar (Vaccine)

🗓️ The Week Ahead

Markets continue to grind higher, although there are signs of cooling momentum, particularly across AI and tech, after months of gains. The ongoing US govt shutdown will be in focus again, potentially delaying key data like the trade balance and jobs report. Additionally, Fed speakers (including Chair Powell) and the start of Q3 earnings season will set the tone for the week.

US Govt shutdown on watch : On Mon, 06-Oct, Senate adjourns to vote on stopgap bills amid failed attempts. House extends recess through 13-Oct, prolonging closure.

US Trade Balance : Tues, 07-Oct. Measures the gap between exports and imports.

Consumer Credit : Tues, 07-Oct. Tracks monthly changes in US household borrowing.

FOMC Minutes : Wed, 08-Oct. Detailed notes from the Fed’s last meeting, providing insight into members’ rate-cut discussions and inflation outlook.

Fed Chair Powell Speech : Thurs, 09-Oct. Investors will watch for any shift in tone following recent data delays and the evolving economic backdrop.

Pepsico (PEP) earnings : Thurs, 09-Oct, BMO. First major report of the Q3 earnings season. Input costs, pricing power, and organic sales growth will be in focus.

Delta Air Lines (DAL) earnings : Thurs, 09-Oct, BMO. Key read on consumer travel and business demand ahead of the holiday season.

Upcoming Economic Data Releases

(subject to Govt shutdown ending)

| Report | Period | Date | Med Fcst |

|---|---|---|---|

| US trade deficit | Aug | 07-Oct | -$60.7B |

| Consumer Credit | Aug | 07-Oct | $14.0B |

| Consumer Sentiment (prelim) | Oct | 10-Oct | 53.5 |

Upcoming Notable Earnings

🎯 This Week’s Pick

Before diving into this week’s pick, here’s a snapshot of how our recent picks have done :

Kenvue

| Market Cap | P/E | Fwd P/E | YTD |

|---|---|---|---|

| $30.34B | 21.48 | 14.50 | -25.95% |

Cautionary Note

Due to ongoing political scrutiny regarding Kenvue’s Tylenol brand by the US admin, this is a high-risk play as sentiment is weak. Investors should be aware of potential near-term volatility that will likely be driven by news headlines and political developments rather than company fundamentals.

Profile

Kenvue, one of the world's largest consumer health companies, was spun off from J&J in 2023. Kenvue owns an iconic portfolio of household brands such as Tylenol, Benadryl, Neutrogena, Listerine, and Band-Aid. With annual revenue exceeding $15 billion, Kenvue's stable business is pillared on consumer demand for essential, everyday health products, making its revenue resilient and non-cyclical.

Fundamental Overview

Kenvue is a mature business with $15B+ annual revenue and a 58% gross margin. It trades at a deep discount, with a forward P/E of ~14.50 vs the sector mean of ∼21.0, and has an attractive 5.28% dividend yield. However, sales growth remains in the low single digits, the balance sheet carries a high debt/equity ratio of 0.81, and its Tylenol brand (10% of sales) poses a risk of further valuation cuts if political/legal headwinds worsen.

Technical Overview

Kenvue has been in a downtrend since breaking below its long-term support at $20.32, following the Tylenol headlines. The stock is now deeply oversold on both its daily and weekly RSI (Relative Strength Index), a momentum indicator that measures how overbought or oversold a stock is. Given this setup, I expect these oversold readings to ease as value buyers step in, potentially driving a mean reversion back toward the next resistance level of $17.15 in the short term.

🚀 Future Play

Dynatrace

| Market Cap | P/E | Fwd P/E | YTD |

|---|---|---|---|

| $14.95B | 30.51 | 27.37 | -8.79% |

Profile

Dynatrace is a software intelligence company that sells an AI-powered observability platform. As companies move their apps and data to complex, multi-cloud environments, Dynatrace acts as a brain that monitors every single piece of their software infrastructure. It automatically collects, analyzes, and uses AI to find the root cause of performance issues such as slow websites and failing servers, often before users even notice. This is a crucial service for banks, retailers, and any large business that depends on a perfect digital experience.

Competitive Advantage

Dynatrace differentiates itself through its AI-driven Davis engine, which automatically detects anomalies, pinpoints root causes, and reduces the need for manual troubleshooting. This saves IT teams hours of manual work. By contrast, competitors like Datadog focus more on dashboards and metrics, while Splunk is still known for older log-based systems that often require more human analysis. It also works seamlessly with big names like AWS, Azure, and Google Cloud, making it a go-to choice for modern enterprises.

Fundamental Overview

Dynatrace shows an attractive mix of growth and profit rarely seen in cloud software. Its Annual Recurring Revenue (ARR) hit $1.82 billion in its most recent quarterly earnings (up 16% YoY), with total quarterly revenue at $477 million. It also has a strong 30% operating margin and a healthy 56% free cash flow margin (percentage of revenue converted to cash), reflecting an efficient, profitable business.

Risks & Considerations

Dynatrace faces strong competition from rivals like Datadog and Splunk, all fighting for leadership in cloud monitoring. Furthermore, the 16% ARR growth is slower than past periods, meaning the company must prove it can re-accelerate growth by successfully expanding its platform. Investors must also monitor the sales strategy restructuring announced during its most recent quarterly earnings, as execution issues here could lead to temporary disruption and volatility.

👋🏼 About The Author

Ali Husain

Ali is a full-time equity trader and investor based in Dubai, and the founder of First Mile Investing. He left his corporate career in 2024 to pursue his passion for the markets. He founded First Mile Investing to help beginners take their first confident steps into investing, with the goal of making the process less intimidating, more accessible, and empowering for everyone.

Know someone who might find this newsletter useful?

Or reach out to us at [email protected] if you have some feedback.

Ready to take the next step in your investing journey?

At First Mile Investing, we walk you through the basics of account setup and portfolio building so you feel confident making your own informed investing decisions.

Copyright Notice

All content, analysis, and visuals in Markets Weekly are the intellectual property of the author. Unauthorized copying, distribution, or reproduction of this newsletter, including its images, ideas, and research, is strictly prohibited without prior written consent.

Disclaimer

The weekly newsletters are not trade alerts or recommendations to buy or sell any securities. First Mile Investing is not a licensed financial advisor. The information shared is for educational and informational purposes only and should not be considered financial advice. Investing involves risk, including the possible loss of capital. While risks can sometimes be managed, all investment decisions are your sole responsibility. Always conduct your own research before making any financial decisions. We are simply sharing opinions and educational material with no guarantee of profits or protection from losses.