Welcome to Markets Weekly! The market continued its melt-up as the Fed delivered a rate cut and signaled further easing ahead. Here’s everything you need to know and more.

🪚 Fed cuts rates

🛑 China bans NVIDIA

💾 Huawei launches AI chip

🎵 TikTok nears U.S. deal

💰 NVIDIA backs Intel

Read on below.

📢 Reader’s Voice

"I found the weekly spotlight about data centers super informative last week, and the market recap gives me great talking points for client conversations.”

- Wafir Manakad, McKinsey & Co, Dubai

Have insights or feedback? Reply with your thoughts for a chance to be featured to 1K+ readers

📈 Last Week’s Recap

Stocks pushed higher across the board, with tech, financials, and small caps leading. Headlines were once again dominated by semiconductors, AI, and global trade talks.

Index | Price | MTD | YTD |

|---|---|---|---|

S&P500 | 6,664.4 | 3.16% | 13.31% |

Dow 30 | 46,315.3 | 1.69% | 8.86% |

Nasdaq 100 | 24,626.3 | 5.17% | 17.20% |

BTC / USD | 115,750 | 6.97% | 23.90% |

Gold (GLD) | 339.2 | 6.64% | 38.20% |

USD (DXY) | 97.65 | -0.11% | -9.99% |

Key Takeaways

US Retail sales rise : August retail sales rose 0.6% vs 0.2% forecast, ex-autos +0.7%. Consumers kept up spending despite tariffs and labor market weakness.

Retail sales measure total spending by consumers on goods and services at stores, online, and restaurants.Musk buys $1B in Tesla stock : Elon Musk disclosed a $1B personal purchase, boosting confidence in Tesla. TSLA finished the week up 8%.

China bans Nvidia AI chips : Regulators ordered tech giants to halt RTX Pro 6000D orders, citing comparable domestic alternatives. Move seen as both domestic priority and trade tactic.

Huawei unveils new AI chips : The Ascend 950 launches next year, followed by the 960 in 2027 and 970 in 2028, further pressuring NVIDIA’s China business.

TikTok nears US deal : Trump extended the ban deadline to Dec. 16 as talks progress. Oracle to handle U.S. user data. Beijing says deal needs work.

Trump pushes for Cook’s removal : Admin asked the Supreme Court to oust Fed Governor Lisa Cook, part of President Trump’s broader effort to reshape the central bank.

Nvidia invests $5B in Intel : Partnership centers on next-gen PC and data-center platforms. Many see it as part of a U.S. push to revive Intel’s role. Intel finished the week up 23%.

UK secures £150B US investment : Blackstone to invest £90B over a decade, with Microsoft (£22B), Google (£5B), Prologis (£3.9B), and Palantir (£1.5B) notable others.

Homebuilder Lennar earnings mixed : Q3 EPS was boosted by its Opendoor investment, but revenue and margins missed. Lennar relied on discounts and mortgage incentives to move homes, underscoring ongoing housing affordability pressures.

FOMC Recap

What Happened

The Fed cut rates by 25 bps to 4.00–4.25%, its first cut this year. The decision followed weak labor market data in recent weeks. Fed Chairman Jerome Powell stressed the cut was “risk management,” aimed at cushioning the labor market, not the start of aggressive easing.

What’s Ahead

The updated dot plot shows three cuts in 2025 (up from two in June). Still, policymakers are deeply split: some foresee no more cuts, others expect over a full point. GDP and employment forecasts improved slightly, but the wide dispersion underscores just how uncertain the economic path forward remains.

What It Means For You

Lower rates gradually ease borrowing costs for mortgages, credit cards, and business loans. The stock market usually welcomes cuts. Historically, when the Fed cuts at all-time highs, markets have been higher a year later every single time. Still, easing policy can lift inflation, making it important to own inflation-resilient assets such as precious metals, real estate, or quality dividend-paying stocks.

Notable Earnings Recap

Name | Qtr Rev | Qtr EPS | YTD |

|---|---|---|---|

General Mills (GIS) | $4.52B | $0.86 | -21% |

Fedex (FDX) | $22.2B | $3.83 | -16% |

Lennar (LEN) | $8.81B | $2.29 | 2% |

🔦 Weekly Spotlight

What is the PEG Ratio?

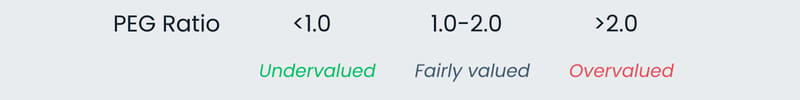

The PEG ratio, or price-to-earnings-to-growth ratio is a valuation tool that helps you determine if a stock’s price and P/E multiple is justified, by taking into account its future earnings growth.

Why It Matters?

The PEG ratio is especially useful for growth stocks. These companies often have high P/E ratios because investors pay a premium for future potential. By factoring in expected earnings growth, the PEG ratio puts those high valuations into clearer context.

A lower PEG ratio suggests a more attractive valuation.

How It Is Calculated

The formula is simple. You divide the stock's Price-to-Earnings (P/E) ratio by its expected annual Earnings Per Share (EPS) growth rate.

The EPS growth rate is a consensus estimate of a company's future earnings by financial analysts, typically over a 1-5 year period.

Let’s take Apple (AAPL) for example:

AAPL P/E ratio = 36

AAPL Projected EPS growth (2026) = 10%

AAPL PEG = 36/10 = 3.6

Indicating that AAPL is currently trading at a premium relative to its expected growth.

🗓️ The Week Ahead

The week ahead is packed with market-moving events, from Fed speakers to critical data releases. The spotlight will be on PCE inflation. A hotter-than-expected print, alongside firm GDP, manufacturing, and sentiment data, could force the Fed to rethink its rate-cut path and temporarily slow the market’s melt-up.

Fed Chair Powell speech : Tues, 23-Sep, alongside a packed week of Fed speakers offering insights on monetary policy.

Micron (MU) earnings : Tues, 23-Sep, AMC. Investors watching memory chip demand and AI tailwinds.

US New Home Sales : Wed, 24-Sep

New Home Sales tracks the monthly purchases of newly built homes.US Q2 GDP final estimate : Thurs, 25-Sep

US Existing Home Sales : Thurs, 25-Sep

Existing Home Sales measures the monthly sales of previously owned homes, a key gauge of housing demand in the secondary market.Costco (COST) earnings : Thurs, 25-Sep, AMC. Focus will be on consumer spending resilience

US PCE & Core PCE inflation : Fri, 26-Sep

Personal Consumption Expenditures (PCE) : Tracks price changes in consumer spending on goods & services.

Core PCE : PCE excluding food & energy.UMich Consumer Sentiment : Fri, 26-Sep

Consumer Sentiment measures consumer confidence in the US economy via surveys. Above 80 indicates optimism, while below 70 indicates rising pessimism.

Upcoming Economic Data Releases

Report | Period | Date | Median Forecast |

|---|---|---|---|

New Home Sales | Aug | 24-Sep | 650K |

US GDP Est | Q2 | 25-Sep | 3.3% |

Existing Home Sales | Aug | 25-Sep | 3.95M |

PCE YoY | Aug | 26-Sep | 2.7% |

Cons Sent | Sep | 26-Sep | 55.4 |

Upcoming Notable Earnings

Name | Date | EPS Est | YTD |

|---|---|---|---|

Micron (MU) | 23-Sep | $2.67 | 86% |

Accenture(ACN) | 25-Sep | $2.98 | -31% |

Jabil (JBL) | 25-Sep | $2.78 | 57% |

Costco (COST) | 25-Sep | $5.79 | 5% |

🎯 This Week’s Pick

Berkshire Hathaway

BRK-B $492.85 (0.48%)

Profile

Berkshire Hathaway is a diversified holding company led by Warren Buffett (who will be succeeded by Greg Abel in 2026). It owns a mix of businesses like GEICO, BNSF Railway, and Berkshire Energy, and holds large equity stakes in companies such as Apple, Coca-Cola, and American Express. With its vast cash reserves and broad exposure across industries, Berkshire is often viewed as a proxy for the overall U.S. economy.

Fundamental Overview

Berkshire Hathaway’s model balances cyclical businesses with equity investments. Its Q2 2025 operating earnings fell ~4% to $11.16 billion, driven by weaker insurance underwriting, though investment income benefited from higher interest rates. With ~$340 billion in cash, it has flexibility for buybacks, acquisitions or large equity stakes. Trading at a ~1.5x book value, its stable cash flow and strong balance sheet make it solid defensive play, particularly if we see weakness in the broader market.

Technical Overview

BRK-B sold off -16% between its Q1 earnings in May and Q2 results in August, but has since rebounded ~8%. The stock has reclaimed its 50 and 200-day moving averages and is consolidating at a key $490 support level. It is looking to potentially embark on an uptrend towards the next resistance level at $506.

🚀 Future Play

Phreesia

PHR $23.87 (-1.08%)

Profile

Phreesia is a healthcare SaaS company that streamlines patient intake, registration, and payments. Its platform automates scheduling, insurance verification, check-in, and billing, helping clinics cut paperwork and errors. For example, when a patient arrives at a doctor’s office, Phreesia enables digital check-in, real-time insurance verification, and secure payments, saving staff time and improving efficiency.

Competitive Advantage

Phreesia is deeply embedded in clinical workflows, creating high switching costs for providers. Unlike broader competitors like as Epic Systems, Oracle Cerner, or athenahealth, it focuses narrowly on intake and payments, a segment ripe for AI adoption. With millions of patient interactions, Phreesia can apply AI to predict no-shows, optimize scheduling, detect billing errors, and personalize reminders. This targeted approach could give it an edge over larger, less specialized rivals.

Fundamental Overview

In its most recent quarter, Phreesia reported revenue of $117.3 million, up ~15% YoY, led by payments and subscriptions. Importantly, it turned profitable with net income of $0.7 million, reversing a loss in the prior year. The company also reported improved free cash flow and holds about $190 million in cash. Analyst price targets in the $33–34 range imply ~35–40% upside from current levels around $24.

Risks & Considerations

Phreesia’s profitability is still nascent, and prolonged investment in growth could pressure margins. Budget-constrained providers may delay adopting new SaaS tools, while larger players like Oracle Cerner or Epic could expand into intake and payments. Execution risk is key. Missing growth targets or slower AI adoption could lead to volatility.

👋🏼 About The Author

Ali Husain

Ali is a full-time equity trader and investor based in Dubai, and the founder of First Mile Investing. He left his corporate career in 2024 to pursue his passion for the markets. He founded First Mile Investing to help beginners take their first confident steps into investing, with the goal of making the process less intimidating, more accessible, and empowering for everyone.

Know someone who might find this newsletter useful?

Or reach out to us at [email protected] if you have some feedback.

Ready to take the next step in your investing journey?

At First Mile Investing, we walk you through the basics of account setup and portfolio building so you feel confident making your own informed investing decisions.

Disclaimer:

The weekly newsletters are not trade alerts or recommendations to buy or sell any securities. First Mile Investing is not a licensed financial advisor. The information shared is for educational and informational purposes only and should not be considered financial advice. Investing involves risk, including the possible loss of capital. While risks can sometimes be managed, all investment decisions are your sole responsibility. Always conduct your own research before making any financial decisions. We are simply sharing opinions and educational material with no guarantee of profits or protection from losses.